Lower Your

Nassau County Property Taxes

Automated Solution for Just $79 ($99/year starting 2026)

Experience Complete Service!

Our full filing service: seamless process management and transparent data sharing, ensuring you're informed every step of the way.

Why Traditional Tax Grievance Companies

Might Not Be Your Best Choice

Before you commit to a traditional tax grievance company, understand the The "No Fee Unless We Win" Trap and long-term implications of their service model.

The "No Fee Unless We Win" Trap

While traditional companies advertise "no fee unless we win," they often fail to mention important details:

- Even with reduced assessed values, your taxes may not decrease significantly due to inflation and rising budgets

- They take a percentage of any savings, which can lead to higher overall costs if taxes increase in the future

Long-Term Cost Impact

Consider these factors when evaluating your options:

- Percentage-based fees compound over time, potentially costing you thousands more

- Future tax increases could result in even higher fees for traditional companies

Traditional Company

30% of Your Savings as Fee

Example Property

Our Service

Simple Flat Fee of $79/year

Same Property

The most common misconceptions about property tax assessments and disputes.

Learn how we can help you reduce your property taxes

What Our Clients Say (16 Reviews)

Join hundreds of satisfied homeowners who have successfully appealed their property taxes

Dr. Jeoun

Roslyn

"Wow this app is absolute brilliant! I am going to recommend it to all my friends and colleagues."

Mr. Song

East Meadow

"Thank you! I'll definitely be referring your website to everyone I know as well."

Mr. Hong

East Meadow

"It is so easy to use!"

Mr. Ma

Bellmore

"I am impressed by the ease of use!"

Mrs. Chen

Great Neck

"The automated process saved me so much time. Highly recommended!"

Mr. Patel

Hicksville

"Got my property tax reduced by 15%! The service was excellent."

Dr. Kim

Manhasset

"Very professional and efficient. The results exceeded my expectations."

Mrs. Rodriguez

Mineola

"The customer support was outstanding. They guided me through every step."

Mr. Thompson

Port Washington

"Saved me thousands on my property tax. Worth every penny!"

Ms. Lee

Garden City

"The online platform made everything so simple. No paperwork hassle!"

Mr. Gupta

New Hyde Park

"Fast response time and great results. Will use again next year!"

Mrs. O'Connor

Rockville Centre

"The most user-friendly tax grievance service I've ever used."

Mr. Zhang

Floral Park

"Got my assessment reduced by 20%. The process was seamless!"

Dr. Martinez

Lynbrook

"Professional service with excellent results. Highly satisfied!"

Mrs. Singh

Valley Stream

"The automated system is brilliant. Saved me so much time!"

Mr. Wilson

Oceanside

"Best investment I made this year. The results were amazing!"

Ms. Park

Plainview

"Very efficient service. Got my tax reduction quickly!"

Mr. Cohen

Woodmere

"The online platform is intuitive and easy to use. Great experience!"

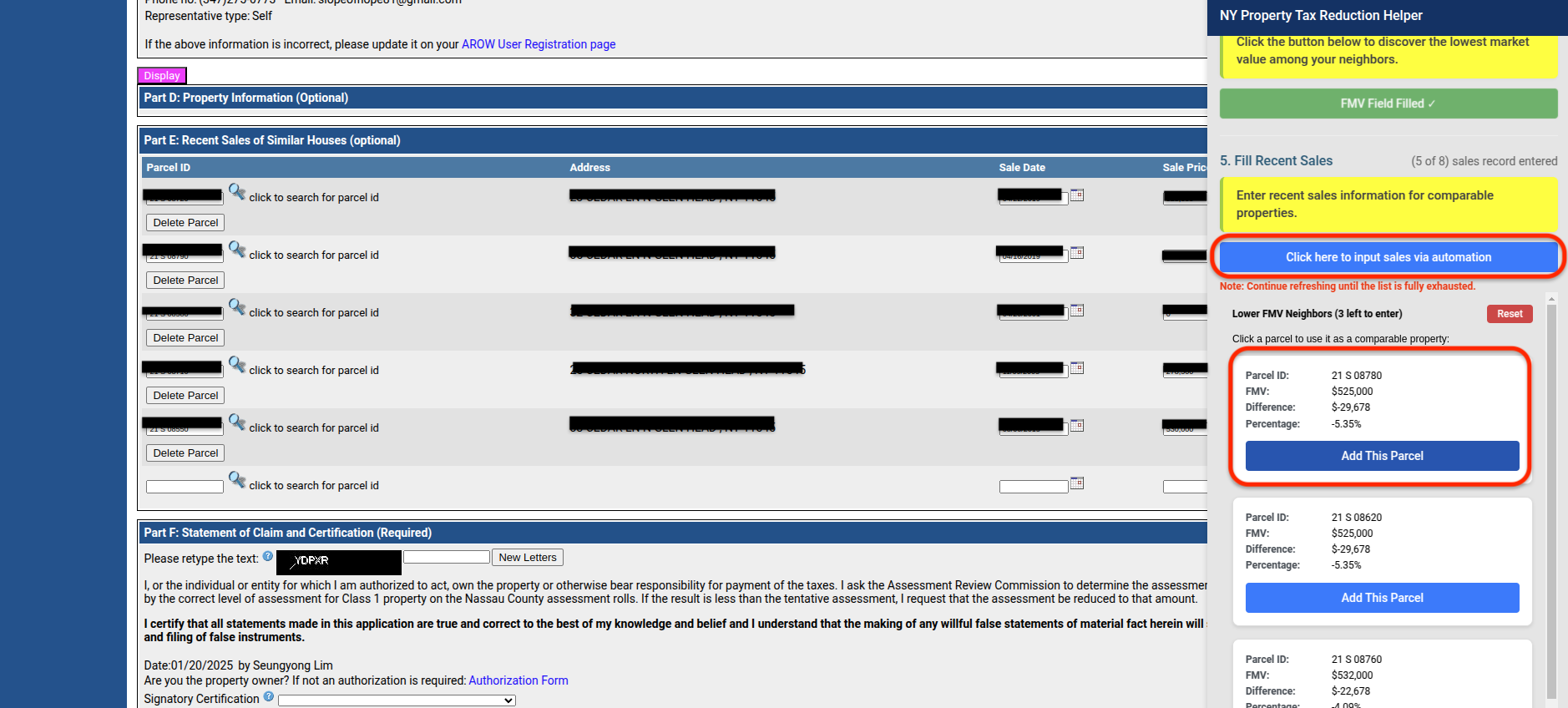

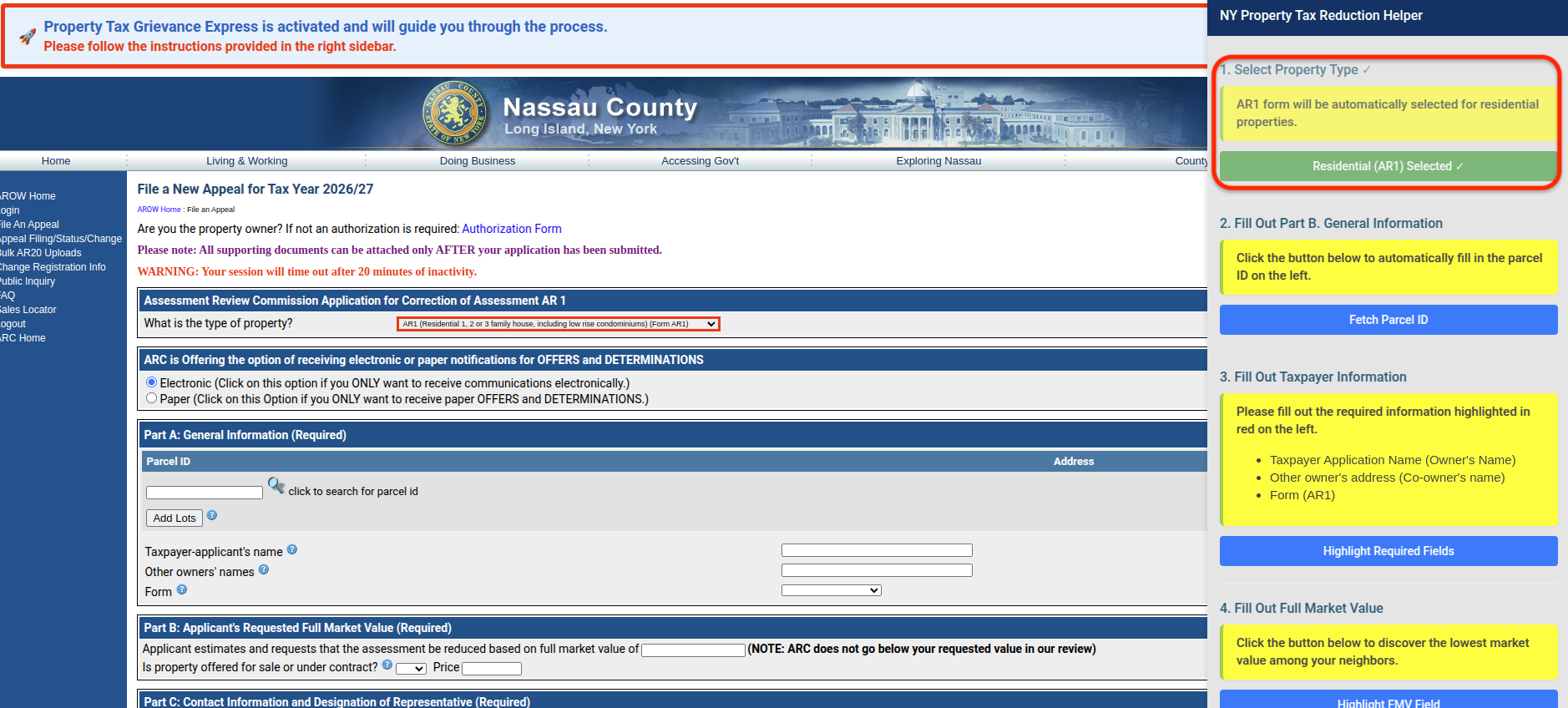

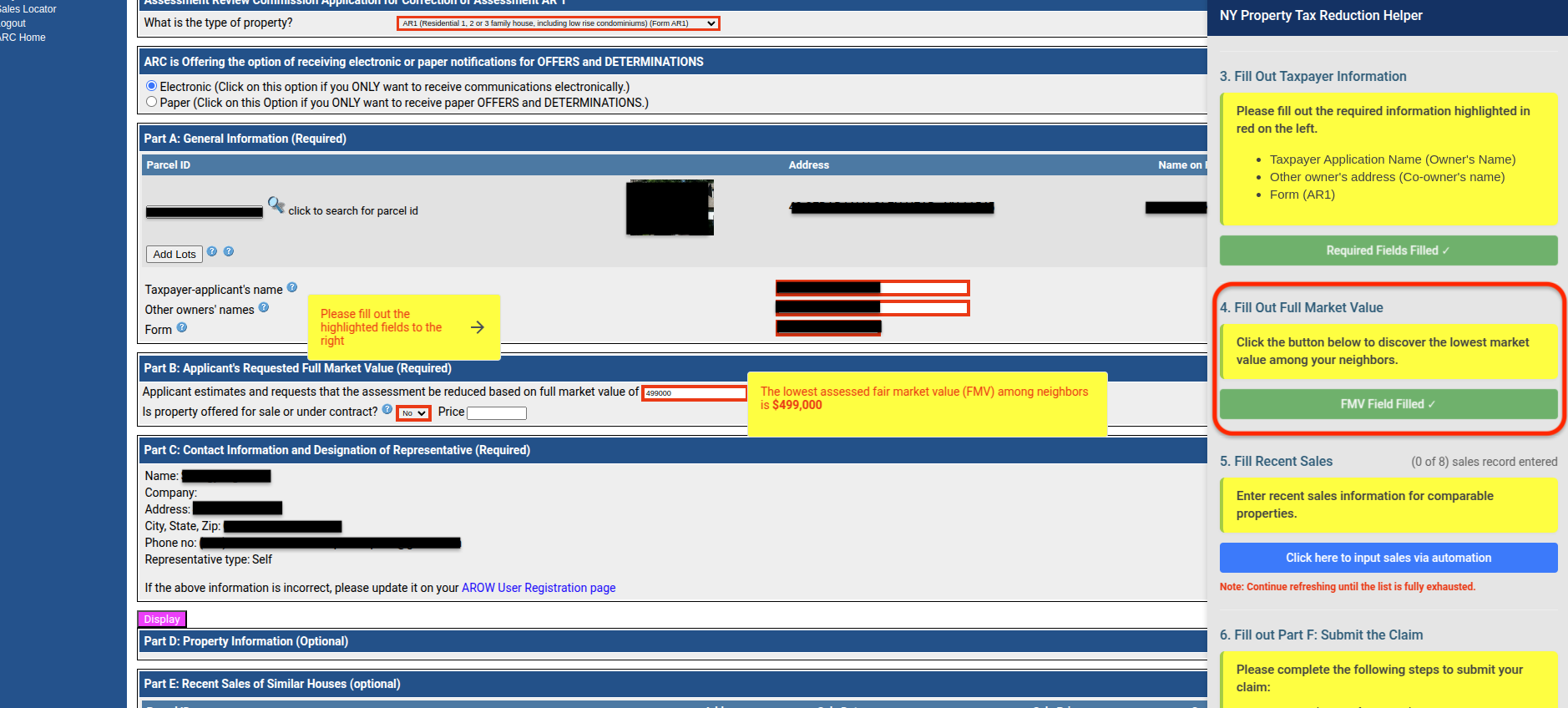

How It Works Behind the Scenes

Only 4 simple actions required from you, while our advanced system handles the complexity

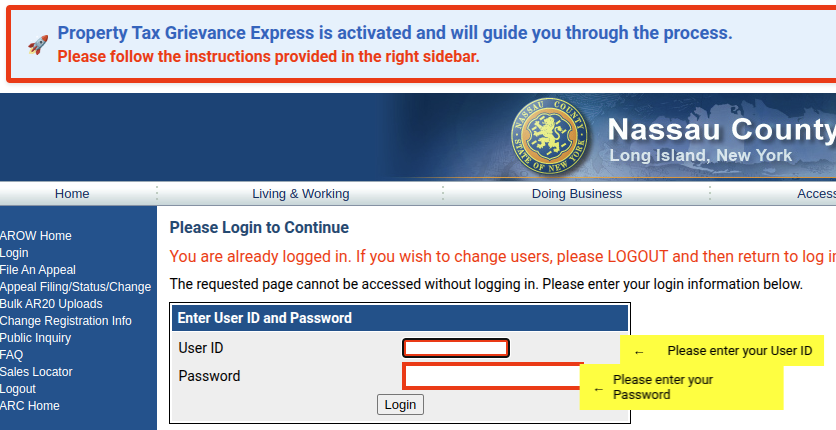

Sign up with Google

Secure and quick registration process with your Google account

Make a payment

One-time payment of $79 ($99/year starting 2026) for complete service

Enter your address

Provide your Nassau County property details

Sign authorization

Digitally authorize us to file on your behalf

Our automated system, powered by advanced AI

Leveraging cutting-edge technology to handle the entire process with precision and efficiency

Features

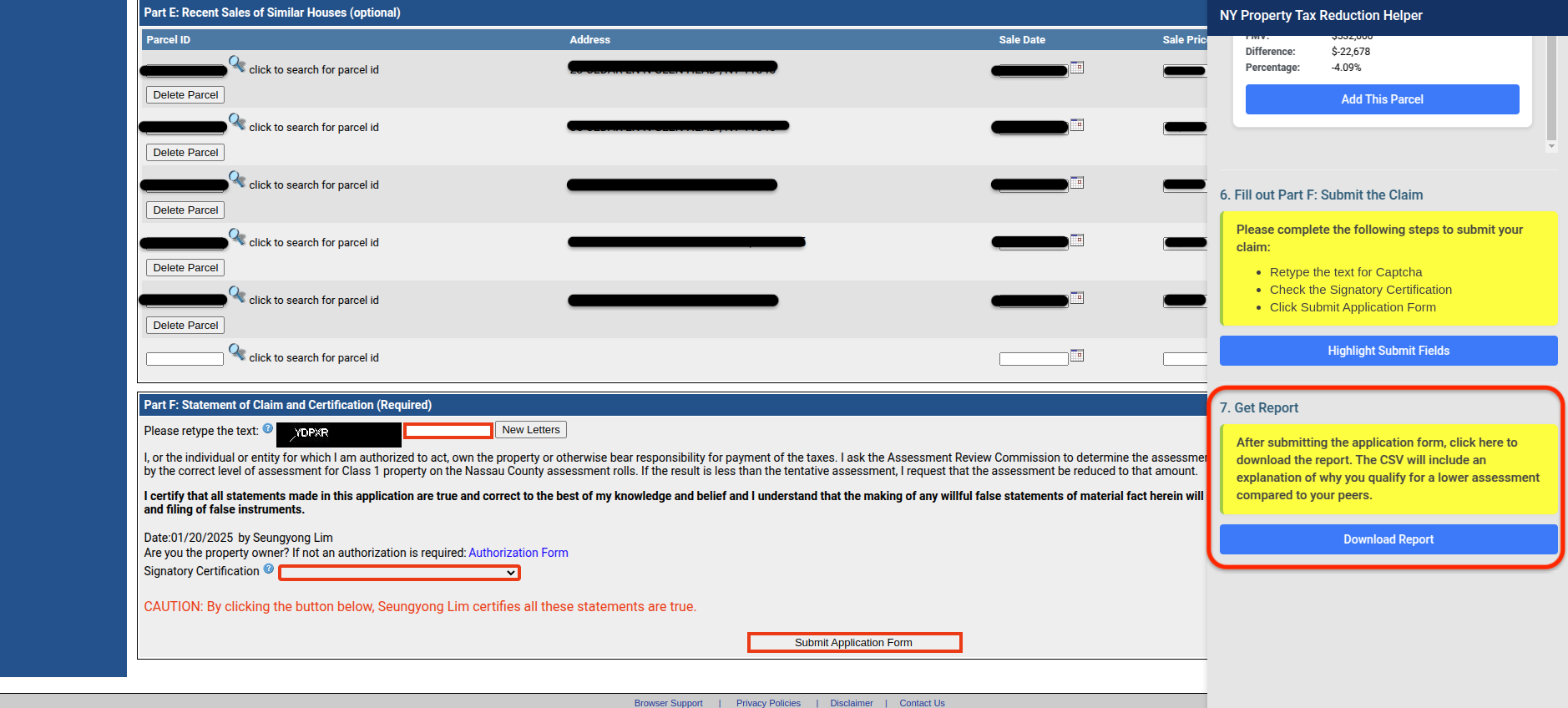

Our system automates the entire process through our advanced Chrome extension, ensuring accurate and efficient submission of your property tax appeal

Automated Navigation System

Advanced AI technology precisely navigates the Nassau County interface, automating form field identification and data entry with enterprise-grade accuracy.

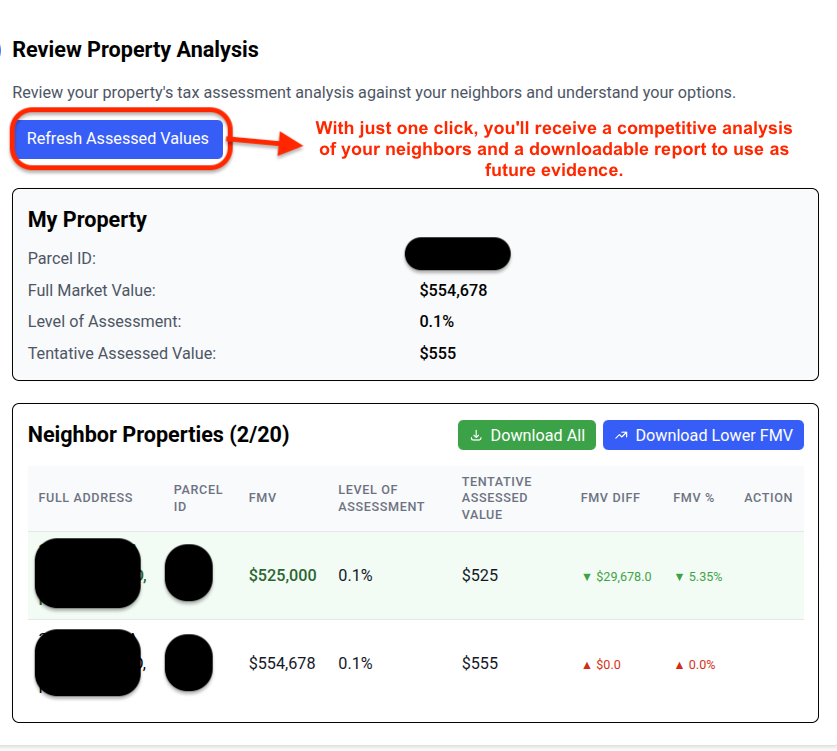

Real-time Value Analysis

Sophisticated algorithms continuously analyze property values and assessment data to build the strongest possible appeal case.

Smart Form Processing

Advanced validation system ensures complete and accurate form submission by automatically verifying all required information.

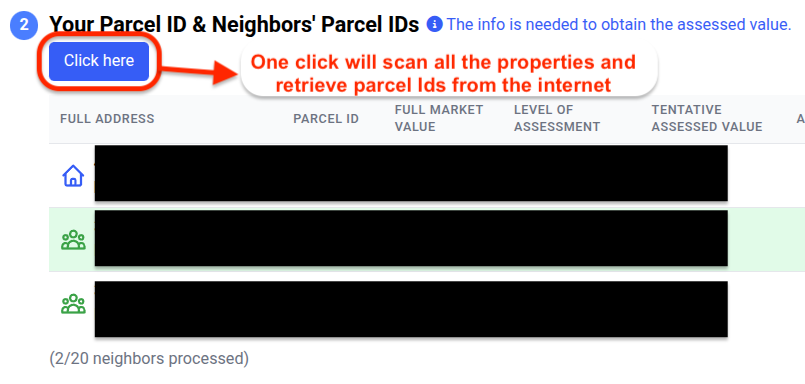

Automated Data Retrieval

Sophisticated data extraction system automatically retrieves and validates property information from Nassau County databases.

Value Optimization Engine

Advanced algorithms calculate optimal Fair Market Value using comprehensive market analysis and property comparisons.

Automated Reporting System

Comprehensive reporting engine generates detailed property comparisons and supporting documentation for maximum appeal effectiveness.

Automated Parcel ID Lookup

Our intelligent system automatically retrieves and validates your property's parcel ID from official Nassau County records.

Advanced Property Analysis

Our sophisticated algorithms perform comprehensive property value comparisons to build a compelling appeal case.

Effortless Property Tax Grievance Solution

Reduce your property taxes without breaking the bank

Hi! I've reviewed your property at 123 Main Street and found several opportunities to reduce your taxes.

That sounds great! What's the next step and how much will it cost?

Our fee is 30% of your tax savings. No savings, no fee! Just sign here and we'll handle everything.

30%? That's quite high... I'll look for a more affordable option.

Our Solution

We offer the same service for a flat fee of just $79 ($99/year starting 2026). No hidden costs, no percentage fees. Start saving on your property taxes today!